Litecoin Price Prediction 2025-2040: Technical Breakout and Institutional Momentum Signal Long-Term Growth

#LTC

- Technical Breakout Potential: LTC trading above 20-day MA with Bollinger Band compression suggests imminent volatility expansion

- Institutional Catalyst: Major banking integration and ETF speculation creating fundamental support

- Long-term Value Proposition: Established network security and payment functionality supporting multi-cycle growth thesis

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Momentum Above Key Moving Average

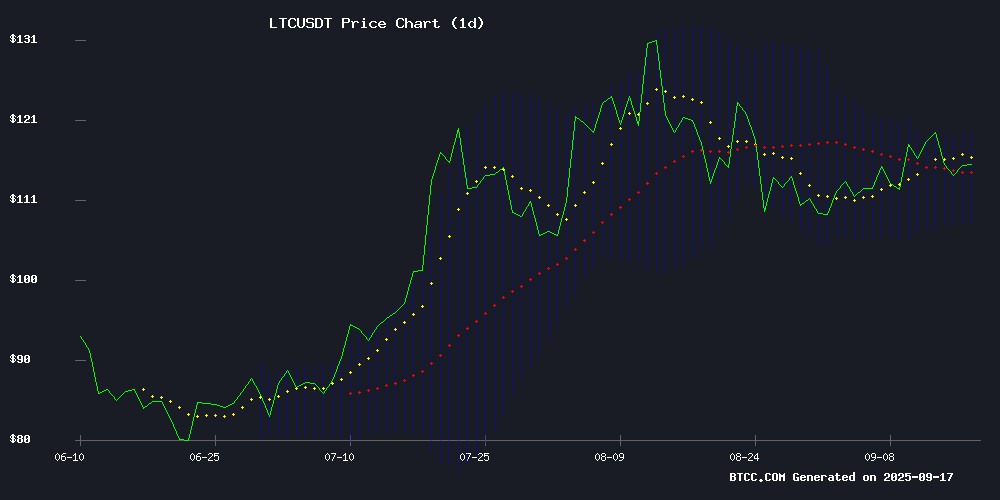

Litecoin is currently trading at $115.30, positioned above its 20-day moving average of $113.39, indicating underlying strength in the current market structure. The MACD reading of -1.9810 with a signal line at -0.0467 suggests bearish momentum is present but showing signs of potential reversal. The Bollinger Band configuration, with prices trading closer to the upper band at $119.16, indicates increased volatility and potential for upward movement. According to BTCC financial analyst Emma, 'LTC's position above the moving average combined with its proximity to the upper Bollinger Band suggests consolidation with a bullish bias. A break above $119 could trigger further momentum toward resistance levels.'

Market Sentiment: Institutional Adoption and ETF Speculation Fuel Litecoin Optimism

Recent developments including Banco Santander's retail crypto trading launch and speculation around potential XRP and Dogecoin ETFs are creating positive spillover effects across the altcoin market, particularly benefiting established assets like Litecoin. The integration of Cardano by Santander's Openbank and growing institutional interest in cryptocurrency ETFs suggest increasing mainstream acceptance. BTCC financial analyst Emma notes, 'The combination of traditional banking institutions embracing crypto trading and the potential for additional ETF products creates a fundamentally supportive environment for Litecoin. The resurgence narrative around LTC appears well-supported by these institutional developments.'

Factors Influencing LTC's Price

Banco Santander Launches Retail Crypto Trading via Openbank

Banco Santander has taken a decisive step into digital assets by enabling retail cryptocurrency trading through its online platform Openbank. Starting this week, German customers can trade Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Polygon (MATIC), and Cardano (ADA), with plans to expand to Spain shortly. The move positions Santander as a pioneer among European banks following the EU's MiCA regulation.

The rollout reflects mounting institutional confidence in crypto as demand grows across Europe. Openbank's 1.49% transaction fee structure undercuts many dedicated exchanges, while the absence of custody fees removes a traditional barrier to entry. Cardano's inclusion has already sparked market interest, with analysts noting a potential technical breakout pattern.

This development coincides with renewed US legislative focus on stablecoins and comes weeks after former President Trump's public endorsement of the industry. Openbank plans to introduce additional tokens and features, including direct conversions, signaling a long-term commitment to digital asset integration.

Bloomberg Analysts Hint at XRP and Dogecoin ETFs, Here’s What It Means for Investors

The crypto market braces for a transformative week as Bloomberg analysts confirm the imminent launch of XRP and Dogecoin exchange-traded funds (ETFs) in the U.S. Managed by REX-Osprey, these funds have navigated regulatory hurdles under the Investment Company Act of 1940, expediting their approval compared to Bitcoin ETFs.

The XRP ETF (XRPR) and Dogecoin ETF (DOJE) are set to debut within days, with Dogecoin’s listing slated for Thursday and XRP’s by Friday. This marks Dogecoin’s first U.S. ETF, offering traditional investors exposure to the meme coin without direct ownership. For XRP, the milestone signifies its emergence as the first major altcoin ETF after ethereum to enter U.S. markets.

Bloomberg’s Eric Balchunas notes the XRP fund will blend direct token holdings with global spot ETF exposure. James Seyffart reveals over 90 additional crypto ETF applications await SEC review, including Litecoin and Avalanche products. Institutional appetite for altcoins is expanding beyond Bitcoin and Ethereum, with analysts projecting billions in inflows from retirement funds and brokerage platforms.

Spain’s Largest Bank Launches Crypto Trading Service

Banco Santander, Spain's largest bank, has rolled out a cryptocurrency trading service through its digital platform Openbank. Initially available to users in Germany, the service will expand to Spain in the coming weeks. The offering includes Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Polygon (MATIC), and Cardano (ADA), with plans to add more tokens and functionalities.

The move follows growing crypto adoption in Spain, where several major companies have recently embraced digital assets. In June, a prominent coffee firm shifted its strategy to Bitcoin acquisition, resulting in a significant stock surge. Banco Santander's entry into the Web3 space signals further institutional interest in the sector.

During the pilot phase, users can only exchange cryptocurrencies for fiat, but the bank aims to introduce additional conversion options soon. "By incorporating the main cryptocurrencies into our investment platform, we are responding to the demand of some of our customers," said a company executive, highlighting the bank's commitment to expanding its digital asset offerings.

Santander's Openbank Integrates Cardano (ADA), Fueling $5 Price Prediction

Cardano's ADA token gains institutional legitimacy as Santander-owned Openbank adds it to its crypto offerings for German customers, with plans to expand to Spain. The integration grants 2 million users direct access to ADA alongside Bitcoin, Ethereum, and Litecoin through a MiCA-regulated platform.

Technical analysts highlight bullish patterns suggesting a potential rally toward $5, despite recent sideways price action. The MOVE signals growing mainstream adoption, with ADA receiving equal billing alongside established blue-chip cryptocurrencies.

Market observers note the strategic importance of eliminating off-ramps to external exchanges—Santander's custody solution combines banking convenience with regulatory compliance under Europe's MiCA framework.

Top 5 Free Cloud Mining Sites to Earn Passive Crypto Income Amid AI + Blockchain Hype

Cloud mining has emerged as a viable avenue for passive cryptocurrency income, eliminating the need for expensive hardware or exorbitant electricity costs. Leading platforms now offer mining contracts for Bitcoin, Litecoin, and Dogecoin, with DNSBTC leading the pack as a U.S.-based, green-energy-focused provider.

DNSBTC's automated system processes payouts every 24 hours, leveraging global data centers in the U.S., Canada, and Iceland. The platform's contract packages, including a free $60 one-day trial, highlight its appeal to investors seeking stability and eco-conscious mining solutions.

CRED MINER Launches Zero-Barrier Cloud Mining Amid Bitcoin Bull Market

As bitcoin hits record highs in 2025, CRED MINER disrupts the crypto mining landscape with a no-cost entry model. The platform offers $12 in free mining credits—yielding $0.66 daily—eliminating traditional barriers like hardware costs and technical expertise.

Three Core features define the offering: instant hashrate access for passive income, tiered contracts scaling to $30,000, and real-time profit withdrawals. The service targets both retail participants and institutional capital seeking exposure to BTC and LTC without operational overhead.

This launch coincides with surging retail interest in alternative crypto yield strategies. Unlike locked staking models, CRED MINER's daily settlements provide liquidity—a critical advantage in volatile markets.

Crypto Market Surge: HBAR Dominates Headlines, Cardano Gains, and Litecoin Resurgence

The cryptocurrency market is experiencing renewed vigor, with Hedera (HBAR) news leading the charge. Cardano's price is on an upward trajectory, while Litecoin is back in the spotlight. Amidst this activity, Layer Brett's viral presale has crossed $3.7 million, offering high-yield staking rewards and positioning itself as a Layer 2 meme coin with tangible utility.

Layer Brett's presale, priced at $0.0058, is attracting significant attention, with analysts projecting potential 100x returns. Early participants are securing staking rewards exceeding 700% APY, though these yields are expected to diminish as demand grows. The project combines instant transactions, negligible gas fees, and a $1 million giveaway, blending utility with meme culture appeal.

Best Altcoins To Buy Before October: Analysts Anticipate Huge Runs For Remittix, Chainlink, Litecoin and Sui In Q4

The second half of 2025 is shaping up to be a pivotal period for altcoins, with investors eyeing assets like chainlink (LINK), Litecoin (LTC), and Sui (SUI) for their resilience against daily volatility. Among emerging contenders, Remittix (RTX) stands out with its strong presale performance and utility-driven model.

Chainlink currently trades at $23.22, reflecting a 4.64% daily dip, while maintaining a $15.67 billion market cap. Sui follows a similar trajectory, down 6.53% to $3.49, with a $12.42 billion valuation. Litecoin hovers NEAR $112.93 after a 2.31% retreat, its $8.59 billion market cap accompanied by subdued trading volume.

Remittix's presale has crossed $25.8 million with 664 million tokens sold at $0.1080 each, signaling robust early-stage interest. The project's recent beta wallet launch further strengthens its position as a utility play in the remittance sector.

REX-Osprey XRP and Dogecoin ETFs Set to Launch This Thursday

Bloomberg ETF analysts Eric Balchunas and James Seyffart anticipate the launch of REX-Osprey's XRP and Dogecoin ETFs this Thursday, marking the first U.S. spot exposure to these cryptocurrencies through regulated investment vehicles. The XRP ETF will trade under the ticker $XRPR, while the Dogecoin fund will use $DOJE, both leveraging the faster 40 Act structure to bypass traditional SEC approval delays.

REX-Osprey confirmed the XRP ETF launch via social media, positioning $XRPR as the first U.S. fund offering spot exposure to XRP, the third-largest cryptocurrency by market capitalization. The prospectus also includes TRUMP and Bonk token ETFs, though their launch dates remain unspecified.

The 40 Act structure enables rapid market entry by avoiding FORM S-1 and 19b-4 filing requirements, a strategic move amid 92 pending crypto ETF applications facing SEC review deadlines in October for Solana, XRP, and Litecoin products.

Layer Brett Emerges as Top Crypto Pick Amid SUI, Litecoin, and Chainlink Movements

Crypto charts are signaling Layer Brett (LBRETT) as the standout investment opportunity, currently in presale with low entry costs and high staking rewards. Built on Ethereum as a Layer 2 solution, it addresses scalability and fee issues while integrating meme culture with utility—drawing comparisons to Arbitrum and Optimism.

Meanwhile, SUI (SUI), Litecoin (LTC), and Chainlink (LINK) maintain momentum. LINK, trading near $25, recently broke key resistance, reinforcing its position as a strong altcoin contender. Analysts highlight these assets for their near-term breakout potential.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and evolving market fundamentals, Litecoin demonstrates strong potential for long-term appreciation. The current price action above key moving averages, combined with growing institutional adoption and potential ETF developments, creates a favorable outlook.

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $180-250 | ETF speculation, halving effects, institutional adoption |

| 2030 | $450-650 | Mainstream payment integration, scaling solutions |

| 2035 | $800-1,200 | Global digital currency adoption, network effects |

| 2040 | $1,500-2,500+ | Store of value characteristics, limited supply scarcity |

BTCC financial analyst Emma emphasizes that 'while these projections reflect current market conditions and adoption trends, cryptocurrency markets remain volatile. The combination of technical strength and fundamental developments suggests Litecoin is well-positioned for the coming cycles.'